Independent Contractor Hourly Rate

If you dont want the download the free rate calculator above the math goes like this. Alternatively the contractor can charge a flat rate for the job.

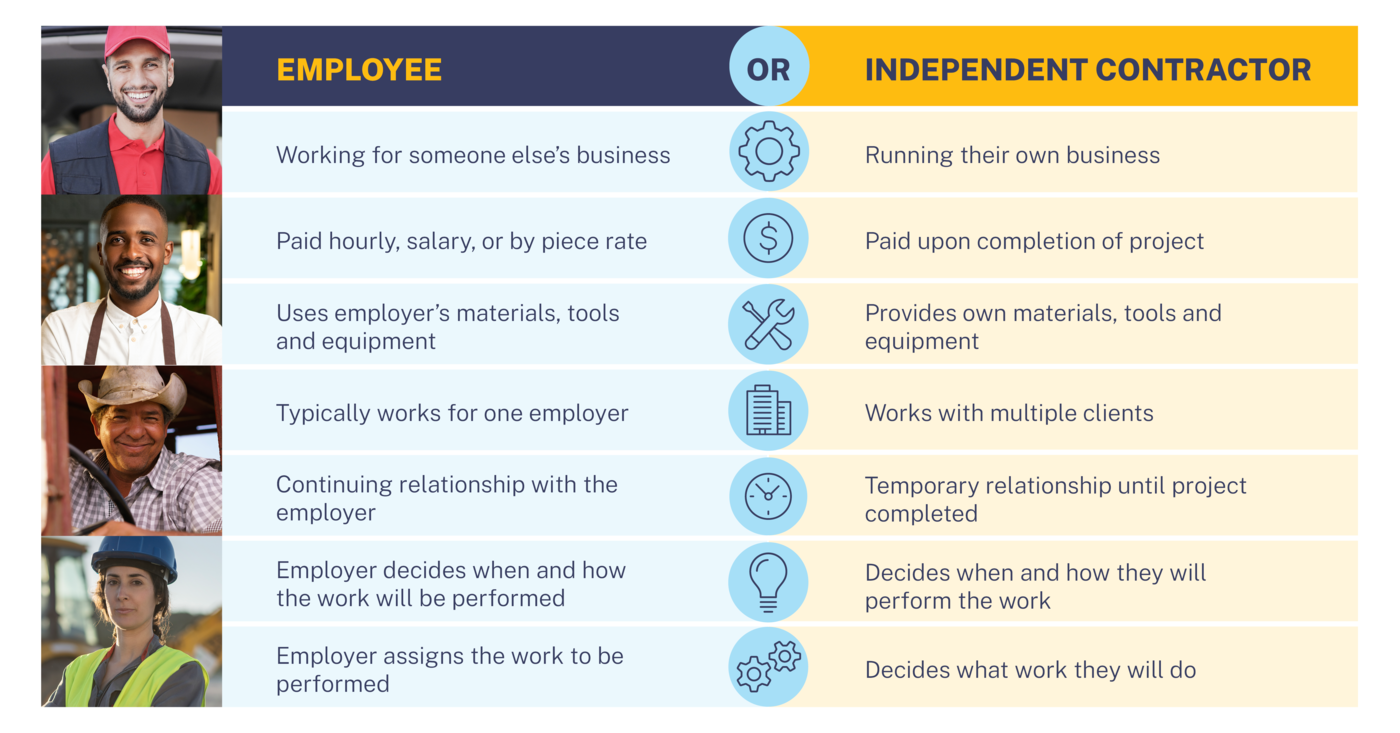

Misclassification Of Employees As Independent Contractors U S Department Of Labor

Federal income tax self-employment tax and potentially state income tax.

. Finally multiply your hourly rate by 8 to reach your day rate. If a contractor bills hourly they should report the number of hours worked on a project down to even half or quarter of hours worked in the agreed upon time frame for payment. An independent contractors income is not considered a salary as there are no additional deductions or withholdings from the business.

A typical invoice usually lists the exact quantity of supplies you provided the. The self-employment tax rate. A contractor invoice template is a document that you issue to bill a company or an individual for the supplies or services you provided.

In most cases businesses do not withhold taxes from any payments to an independent contractor. Employees may also receive certain fringe benefits including an allowance or reimbursement for business or travel expenses. They engage in business activities as an independent entity and include roles such as graphic designers freelance writers construction workers consultants and more.

This is most easily understood in a table format with one column for each piece of information. The independent contractor agreement is there to hold all parties accountable for. Each task or service is recorded in each row.

A clear description of the tasks that the contractor is required to fulfill must be provided in the work agreement. 45 hours worked at 50 per. When you work as an independent contractor you work on an hourly or project-based rate that may vary from client to client or job to job.

An Independent Contractor Agreement needs to set the rate of pay. An independent contractor agreement is a legally binding document between the contractor and client that sets forth the terms and conditions for which work is to be completed. If you work independently you have control over setting and negotiating your rates.

Before you dive in its always wise to do a little market research to see what others in the industry are charging for their services. Can I withhold taxes for an independent contractor. The nature of the services performed is also key to deciding if a worker is an employee or an.

One employed by a contractor who has contracted with the State or a county city town township incorporated village school district body politic or municipal corporation therein through its representatives is not considered as an employee of the State county city town township incorporated village school district body politic or. Now you have your rates. Many invoice formats record this.

BLS Live-in the home Caregiver. A contract may be for a total amount. Earns either an hourly rate or a salary.

Do some market research. An employee pay period must remain the same unless formally changed. Generally speaking truck drivers are hired to transport goods from one facility to another or from a seller to a buyer.

If you contract through an agency you rely on the agency to establish and secure an acceptable rate for each job. Income tax obligations vary based on net business profits and losses among other factors. Its then as simple as multiplying the hours by their hourly rate ie.

This means that some workers will receive both a W-2 and Form 1099. The self-employment tax rate is 153 of which 124 goes to Social Security and 29 goes to Medicare. It could be for an hourly daily or weekly amount that ends on a specific date or a total amount to be paid when the job is completed.

Employees typically are paid a salary an hourly rate of pay or a draw against future commissions with no requirement for repayment of unearned commissions. Pay rate Add applicable tax Subtotal for each service. The final row of your table is the combined total of all the subtotals which forms the amount owing on the invoice.

However a business that enlists the services of a freelancer must send them a Form 1099-NEC at the end of the year to report all income paid during the previous calendar year. Pay periods vary from one week to one month. Individuals classified as independent contractors are not employees of.

Simply put if the caregiver is there to look after the patient and spends no more than 20 of their daily living activities caring for himher the caregiver. As an independent contractor youll have to pay 2 or 3 taxes depending on where you live. They should also list at least high-level information on the services performed during those hours.

A truck driver independent contractor agreement is a document that legally binds a contractor and their client to a working arrangement. A delivery driver depending on the State offering their services may not be paid an hourly wage but on a per delivery basis. Since the federal test for determining whether an individual is an independent contractor is more lenient than Californias it is possible that a worker will be treated as an employee under California employment law but an independent contractor for federal tax purposes.

Total Monthly Living Expenses L Total Monthly Business Expenses B Total Billable Hours Per Month H Total Taxes T Your Minimum Hourly Rate LH 1 T BH Example. So lets say you need to make 5000month to live expect your business expenses to be about. In addition food delivery drivers are commonly paid tips ranging from 5 to 10 of the total amount purchased.

But wait it doesnt end there Step 6. What is a contractor invoice. If the caregiver that is being hired is a family member or a friend that will be living in the same home there may be tax advantages to the employer.

Independent contractors are different from traditional employees which has lead to California independent contractor laws. A contractor can charge an hourly weekly monthly or annual rate. 52 x 8 416.

The Definitive Guide To Contract Attorney Hourly Rates Hire An Esquire

Should I Agree To Be Paid As An Independent Contractor

Determining Hourly Rates For A Contractor Or Small Business Driveyoursucce

Free Contractor Timesheet Templates Word Excel Pdf

Hiring Independent Contractors Vs Full Time Employees Pilot Blog Pilot Blog

Hourly Rate Hr Invoice Template Pdf Word Excel

Hourly Rate Hr Invoice Template Pdf Word Excel